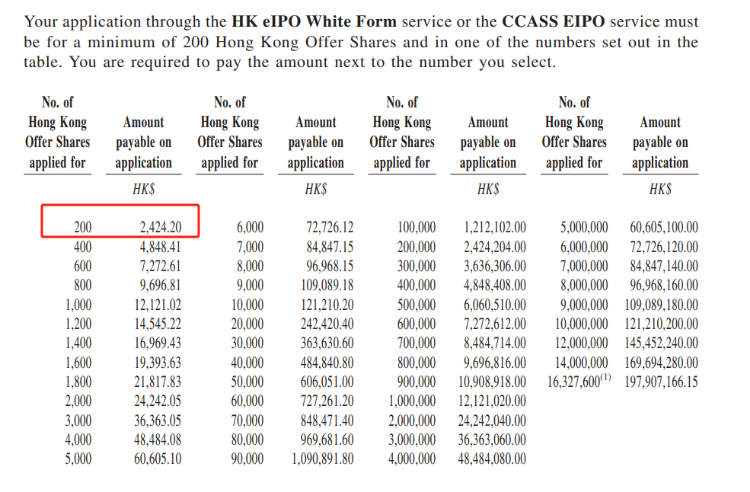

New Stock Offering | J&T Global Express Now Available for Subscription at HK$12 Per Share, And Entry Fee of HK$2424.20

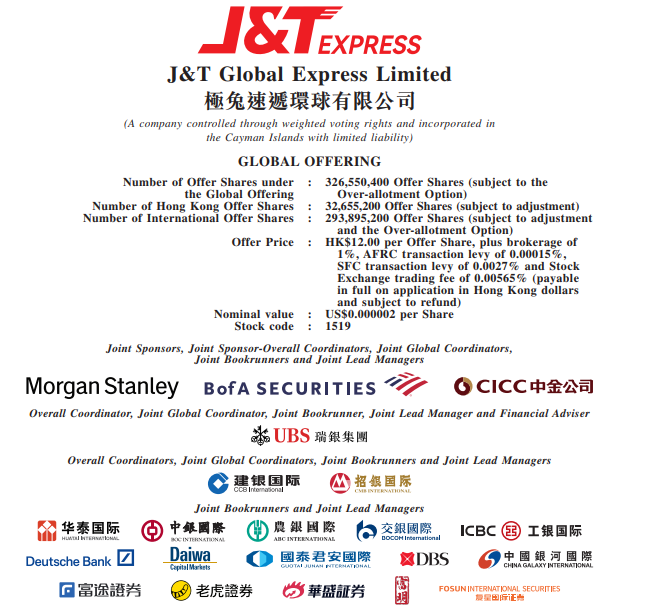

J&T Global Express-W ( $J&T EXPRESS-W 01519.HK$ ) is scheduled to launch its IPO from October 16th to October 19th, 2023, with a proposed global offering of 326.6 million shares.

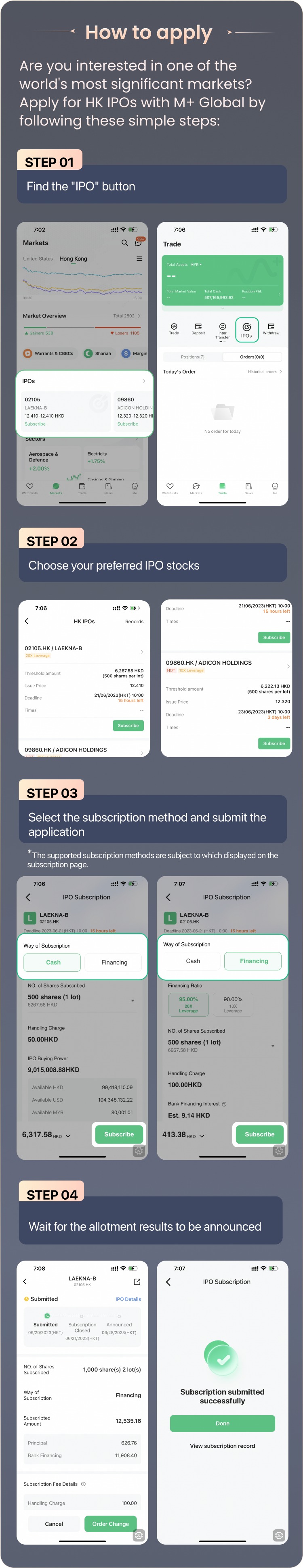

Note: Cash subscription deadline is 18/10(HKT)10:00, Financing subscription deadline is 18/10(HKT)10:00 on M+ Global.

The offering price is set at HKD 12.00 per share, with a minimum lot size of 200 shares. The B-class shares are expected to be listed on October 27th, 2023.

Offering Details

| Offering Details | |

|---|---|

| Number of Offer Shares under the Global Offering | 326,550,400 Offer Shares (subject to the Over-allotment Option) |

| Number of Hong Kong Offer Shares | 32,655,200 Offer Shares (subject to reallocation) |

| Number of International Offer Shares | 293,895,200 Offer Shares (subject to reallocation and the Over-allotment Option) |

| Subscription Fee | HKD 2424.20 per lot |

| Offering Price | HKD 12.00 per share |

| Board Lot Size | 200 shares |

| Offering Period | October 16th to October 19th, 2023 |

| Listing Date | October 27th, 2023 |

| IPO Sponsors | Morgan Stanley, BofA SECURITIES, CICC |

Company Profile:

J&T Global Express is a global logistics service provider with the leading express delivery business in Southeast Asia, a competitive position in China and an expanding footprint in Latin America and the Middle East. Their express delivery services span 13 countries, which include the largest and fastest-growing express delivery emerging markets globally. The company commenced operations in 2015 in Indonesia, and leveraged our success there to expand into other Southeast Asian countries, including Vietnam, Malaysia, the Philippines, Thailand, Cambodia and Singapore, and became the number one express delivery operator in Southeast Asia, with a 22.5% market share in 2022 by parcel volume, according to Frost & Sullivan.

In Southeast Asia, the company handled 2,513.2 million domestic parcels in 2022, representing a CAGR of 47.6% from 1,153.8 million in 2020, and handled 1,438.3 million domestic parcels in the six months ended June 30, 2023, representing an increase of 18.4% from 1,215.0 million domestic parcels in the six months ended June 30, 2022. The company tapped into the express delivery market in China in 2020, and handled 12,025.6 million domestic parcels in 2022, achieving a market share of 10.9% by parcel volume, according to Frost & Sullivan. In China, the company handled 6,445.6 million parcels in the six months ended June 30, 2023, representing an increase of 15.1% from 5,602.3 million parcels in the six months ended June 30, 2022.

As of June 30, 2023, the company had full network coverage across the seven Southeast Asia countries and a geographic coverage of over 99% by counties and districts in China. The company are also the first Asian express delivery operator of scale to have expanded into Saudi Arabia, UAE, Mexico, Brazil and Egypt, according to Frost &Sullivan, supporting their e-commerce partners as they expand into new markets. To better capture cross-border logistics opportunities and enhance the connectivity among the countries they serve, the company have expanded their cross-border logistics services, which include small parcels, freight forwarding and warehousing solutions.

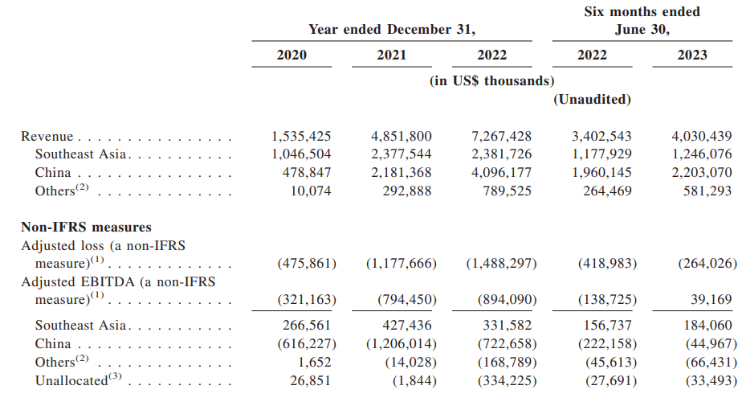

Financial Information:

According to the prospectus, the company's operating revenue for the period from 2020 to 2023H1 was $1.535 billion, $4.852 billion, $7.267 billion, and $4.03 billion, respectively.

Among them, from 2020 to 2021, the Southeast Asian business was the largest contributor to the company's revenue, reaching $1.047 billion and $2.377 billion, respectively. Since 2022, the Chinese business has surpassed the Southeast Asian business and has become the largest revenue contributor, with revenue reaching $4.096 billion and $2.203 billion, accounting for 56% and 55% of the total operating revenue, respectively.

Under non-international financial reporting standards, the adjusted net loss for Jitu was $476 million, $1.178 billion, $1.488 billion, and $264 million, respectively, from 2020 to the first half of 2023. The accumulated loss over the three and a half years exceeded $3.4 billion.

Use of proceeds:

| Allocation (%) | Amount (HK$ million) | Purpose |

|---|---|---|

| 30% | 1,058.4 | Expand the logistics networks, improve infrastructure, and strengthen sorting and warehouse capacity and capabilities in Southeast Asia and other existing marketsExpansion of private equity fund management business |

| 30% | 1,058.4 | Expand in new markets and diverse service offeringDevelopment and strengthening of direct investment business |

| 30% | 1,058.4 | Research and development and technology innovations |

| 10% | $352.8 | General corporate purposes and working capital needs |

(Please note that the values are rounded for simplicity.)

Prospectus of J&T Global Express: https://www1.hkexnews.hk/listedco/listconews/sehk/2023/1016/2023101600009.pdf

How to Subscribe?

M+ Global has officially launched its new stock subscription feature for Hong Kong stocks. Investors can now easily subscribe to new stock offerings through our platform.

Wish you good luck and many profitable investments!

Read More:

Unfamiliar with Hong Kong IPOs? Click here to learn more: HK IPO: Everything You Need to Know