New Stock Offering: TUHU Car Inc.: Subscription Fee of HKD 3,131.26 per Lot with USD 100M Cornerstone Investment

TUHU Car Inc. ( $TUHU-W 09690.HK$ )is set to conduct a public offering from September 14th to September 19th, 2023. The company anticipates that dealings of its Class A shares will begin on Tuesday, September 26th at 9:00 AM Hong Kong time on the Hong Kong Stock Exchange.

Head to the New Stock Center to Subscribe to New Stocks>>

Offering Details

| Offering Details | |

|---|---|

| Number of Shares | 40,617,100 |

| Number of Hong Kong Offer Shares | 4,061,800 Offer Shares (subject to reallocation and the Offer Size Adjustment Option) |

| Number of International Offer Shares | 36,555,300 Offer Shares (subject to reallocation, the Offer Size Adjustment Option and the Over-allotment Option) |

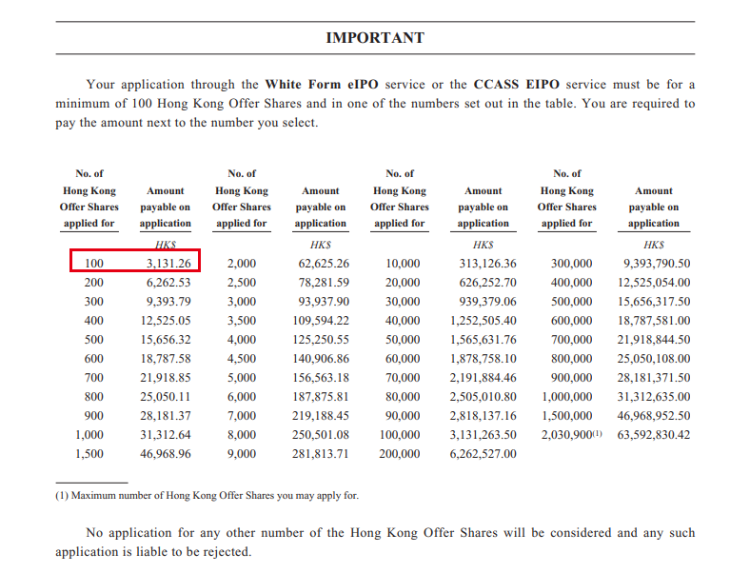

| Subscription Fee | HKD 3,131.26 per lot |

| Offering Price Range | HKD 28-31 per share |

| Board Lot Size | 100 shares |

| Offering Period | September 14th to September 19th, 2023 |

| Listing Date | September 26th, 2023 |

| IPO Sponsors | Goldman Sachs, CICC, UBS, Bank of America |

Company Profile:

TUHU Car Inc. is a leading integrated online and offline automotive service platform in China. With around 100 million registered users and a strong presence in over 4,700 TUHU facilities and 19,000 partner stores, the company has become the largest community of car owners in the country.

By combining technology solutions and a robust digital infrastructure, TUHU Car Inc. has secured a prominent position in the Chinese automotive service market. It ranks first in terms of store count among all automotive service providers and holds the top spot for automotive service revenue among IAM stores in China.

Financial Information:

In 2019-2022, revenues were approximately RMB 7.04 billion, RMB 8.753 billion, RMB 11.724 billion, and RMB 11.547 billion, respectively. Gross profit was RMB 523 million, RMB 1.08 billion, RMB 1.87 billion, and RMB 2.27 billion, respectively. In the first three months of 2023, revenues were approximately RMB 3.265 billion, and gross profit was approximately RMB 790 million. The gross profit margin increased from 7.4% in 2019 to 19.7% in 2022, and further to 24.2% for the three months ended March 31, 2023.

Cornerstone Investors:

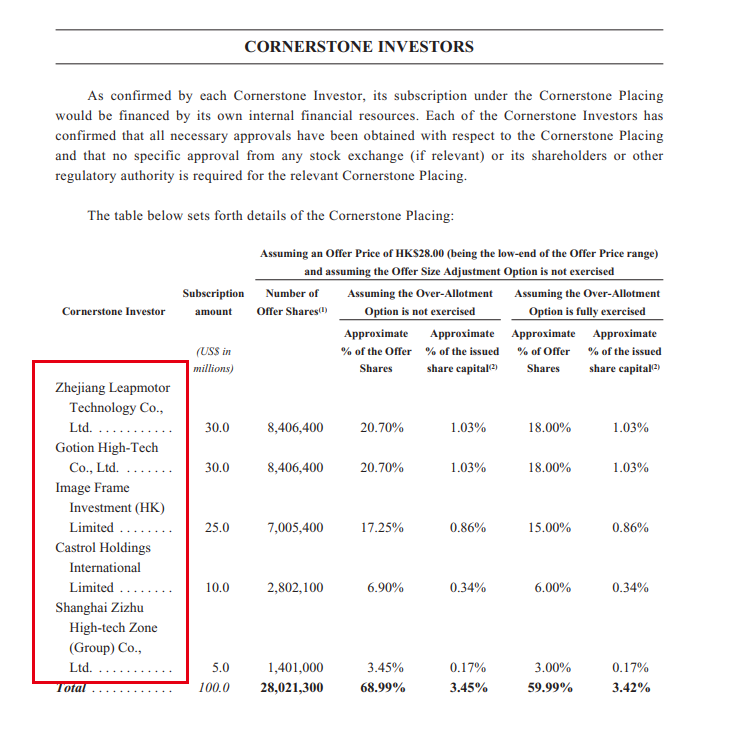

Cornerstone investors have agreed to subscribe for a total of USD 100 million (approximately HKD 784.6 million) worth of shares at the offer price.

Cornerstone investors include Leapmotor ( $LEAPMOTOR 09863.HK$ ), Gotion High-Tech Co., Ltd, and Image Frame Investment (HK) Limited. (ultimately controlled by Tencent Holdings (00700. HK)), Castrol Holdings International Limited, and Shanghai Zizhu High-tech Zone (Group) Co., Ltd.

Use of Proceeds

Assuming an offer price of HKD 29.50 per share and the non-exercise of the overallotment option and the additional offer shares, the net proceeds from the global offering are expected to be approximately HKD 1.091 billion.

The allocation of funds is as follows:

| Percentage | Use of Proceeds |

|---|---|

| 35% | Enhancing supply chain capabilities over the next three years |

| 20% | Research and development to enhance data analysis technology and improve operational efficiency |

| 15% | Expanding the store network and franchisee base, particularly in second-tier and below cities and counties. Also, expanding operation and support teams and strengthening relationships with franchisees |

| 20% | Funding investments related to services for new energy vehicle owners, as well as investments in tools and equipment related to such services |

| 10% | Working capital and general corporate purposes |

Prospectus of TUHU Car Inc.: https://www1.hkexnews.hk/listedco/listconews/sehk/2023/0914/2023091400011.pdf

How to Subscribe?

M+ Global has officially launched its new stock subscription feature for Hong Kong stocks. Investors can now easily subscribe to new stock offerings through our platform.

Wishing you good luck and many profitable investments! Click to the New Stock Center to Subscribe to New Stocks>>